VitalHub Corp. Reports Fourth Quarter and Year-End 2023 Results

TORONTO, March 21, 2024 (GLOBE NEWSWIRE) -- VitalHub Corp. (the “Company” or “VitalHub”) (TSX:VHI) (OTCQX:VHIBF) announced today it has filed its Consolidated Financial Statements and Management's Discussion and Analysis report for the year ended December 31, 2023, with the Canadian securities authorities. These documents may be viewed under the Company’s profile at www.sedar.com.

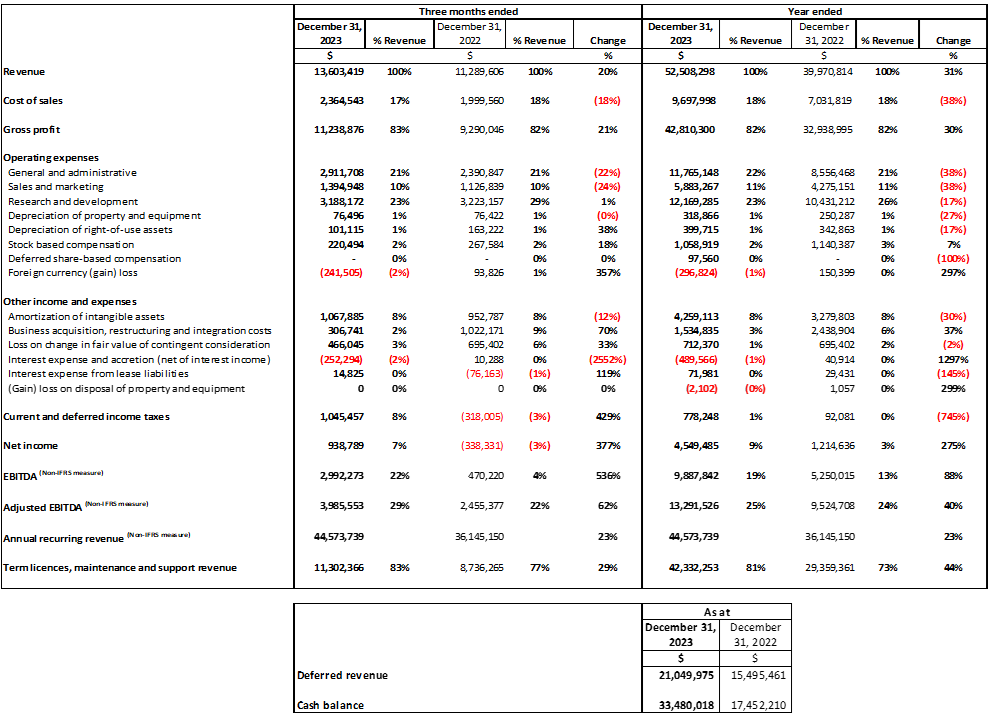

"As VitalHub closes another quarter, it's with a great sense of achievement that we reflect on the strides we've made. Our Q4 2023 revenue reached $13,603,419, marking a 20% increase over the same period last year. This growth underscores the successful execution of our strategy and the unwavering dedication of our team. Q4 gross profit as a percentage of revenue improved to 83%, up from 82% in the prior year quarter, demonstrating our ability to enhance margins while expanding our service offerings. This is a reflection of our growing recurring revenue base to 83% of revenue compared to 77% in the prior year quarter. We achieved Annual Recurring Revenue (ARR) of $44,573,739, a testament to our robust business model and the trust our clients place in our solutions. ARR increased 23% over the same period last year. The bulk of this ARR growth, $6,387,730 or 18%, was organic, $1,100,000 or 3% was from acquisitions, and $938,859 or 3% was from currency fluctuations. Significantly, our EBITDA for Q4 surged by 536% to $2,992,273, and our adjusted EBITDA (Non-IFRS measure) saw a 62% increase to $3,985,553. These figures are a clear indication of our operational efficiency and the scalability of our platform. Notably, our net income before taxes stood at $1,984,246, illustrating a substantial improvement from the previous year and underscoring our fiscal health and the effectiveness of our growth strategies," said Dan Matlow, Chief Executive Officer of VitalHub.

"Looking at the annual highlights, our revenue for 2023 was $52,508,298, a 31% increase from the previous year, with gross profit remaining robust at 82%. Our EBITDA for the year almost doubled to $9,887,842, and we closed with an adjusted EBITDA of $13,291,526, reinforcing our operational strength and market position. Our cash position improved, with $33,480,018 on hand, thanks to our disciplined approach to cash management and operational excellence. This solid financial foundation empowers us to continue our investment in innovation, pursue strategic acquisitions, and further our mission to transform healthcare technology. As we look to the future, our focus remains on driving sustainable growth, expanding our market reach, and delivering exceptional value to our clients and shareholders. With a clear strategy and a dedicated team, I am confident in our ability to navigate the opportunities and challenges ahead. I want to extend my heartfelt thanks to our employees for their dedication and hard work, our customers for their trust and partnership, and our shareholders for their continued support. Together, we are setting new standards in healthcare technology, and I am excited for what the future holds for VitalHub."

VitalHub Corp’s quarterly investor conference call will take place on Friday, March 22nd, 2024, at 9:00AM EST.

To register for the call, please visit:

https://us02web.zoom.us/webinar/register/WN_BERtvZQxTRuBDjh3Q_PO2A#/registration

Fourth Quarter 2023 Highlights

Revenue of $13,603,419 as compared to $11,289,606 in the equivalent prior year period, an increase of $2,313,813 or 20%.

Gross profit as a percentage of revenue was 83% compared to 82% in the equivalent prior year period (Q3 2023 - 82%).

The increase in Q4 2023 was primarily due to higher term licences, maintenance and support revenue, with recurring revenue representing 83% of revenues in the quarter compared to 77% in Q4 2022

ARR ⁽¹⁻²⁾ at December 31, 2023, was $44,573,739 as compared to $42,612,166 at September 30, 2023.

ARR ⁽¹⁻²⁾ growth was due to organic growth in Q4’23 of $1,959,986 or 5% (21.7% annualized).

EBITDA ⁽²⁾ of $2,992,273 compared to $470,220 in the equivalent prior year period, an increase of $2,522,053 or 536%.

Adjusted EBITDA ⁽²⁾ of $3,985,553 or 29% of revenue, compared to $2,455,377 or 22% of revenue in the equivalent prior year period, an increase of $1,530,176 or 62%.

The increase in EBITDA ⁽²⁾ and adjusted EBITDA ⁽²⁾ from Q4 2022 to Q4 2023 was primarily attributable to the higher recurring revenues of $11,302,366 in Q4 2023, as compared to $8,736,265 in Q4 2022, coupled with an ongoing effort to reduce costs and gain operating cost synergies.

Net income before income taxes of $1,984,246 as compared to a net loss of $656,336 in the equivalent prior year period, an increase of $2,640,582 or 402%.

The increase was primarily attributable to the significant increase in revenues from organic growth and acquisitions, coupled with an ongoing effort to reduce costs and gain operating cost synergies.

Annual 2023 Highlights

Revenue of $52,508,298 as compared to $39,970,814 in the equivalent prior year period, an increase of $12,537,484 or 31%.

Gross profit as a percentage of revenue was 82% compared to 82% in the equivalent prior year period.

Gross profit as a percentage of revenue is largely dependent upon the sales mix, with perpetual and term licenses, maintenance and support generating a higher margin than consulting services and hardware revenue.

ARR ⁽¹⁻²⁾ at December 31, 2023 was $44,573,739 as compared to $36,145,150 at December 31, 2022, an increase of $8,428,589 or 23%.

ARR ⁽¹⁻²⁾ benefited from organic growth of $6,387,730 or 18%; growth from acquisitions of $1,100,000 or 3%, and a gain of $938,859 or 3% primarily due to the fluctuation in the GB pound and US dollar rates relative to the Canadian dollar.

EBITDA⁽²⁾ of $9,887,842 compared to $5,250,015 in the equivalent prior year period, an increase of $4,637,827 or 88%.

Adjusted EBITDA⁽²⁾ of $13,291,526 or 25% of revenue, compared to $9,524,708 or 24% of revenue in the equivalent prior year period, an increase of $3,766,818 or 40%.

The increase in EBITDA and adjusted EBITDA from Q4 2022 to Q4 2023 was primarily attributable to the higher recurring revenues of $42,333,253 for the year ended December 31, 2023, as compared to $29,359,361 in the equivalent prior year, coupled with an ongoing effort to manage costs and gain operating cost synergies.

Cash on hand at December 31, 2023 was $33,480,018 compared to $17,452,210 as at December 31, 2022.

The increase was primarily due to an increase in cash generated from operations, as management continues to gain synergies from acquisitions and continues to reduce costs of operations.

Cash from operations before changes in working capital was $11,180,747 as compared to $7,119,817 last year.

Net income before income taxes of $5,327,733 as compared to $1,306,717 in the equivalent prior year period, an increase of $4,021,016 or 308%.

The change in net income was primarily attributable to higher revenues from term licenses, maintenance and support, services and hardware.

(1) The Company defines annual recurring revenue (“ARR”) as the recurring revenue expected based on yearly subscriptions of the renewable software license fees and maintenance services.

(2) Non-IFRS measure.

SELECTED FINANCIAL INFORMATION

ABOUT VITALHUB

Software for Health and Human Services providers designed to simplify the user experience and optimize outcomes.

VitalHub Corp. (the “Company” or “VitalHub”) provides technology to Health and Human Services providers including Hospitals, Regional Health Authorities, Mental Health, Long Term Care, Home Health, Community and Social Services. VitalHub solutions span the categories of Electronic Health Record (EHR), Case Management, Care Coordination & Optimization, and Patient Flow & Operational Visibility solutions.

The Company has a robust two-pronged growth strategy, targeting organic growth opportunities within its product suite, and pursuing an aggressive merger and acquisition (“M&A”) plan. Currently VitalHub serves more than 1,000 clients across Canada, USA, UK, Australia, the Middle East, and Europe.

VitalHub is based in Toronto, Canada, with an offshore development hub in Sri Lanka. The VitalHub team comprises more than 400 team members globally. The Company is publicly traded on the Toronto Stock Exchange (TSX) under the symbol "VHI" and on the OTC Markets OTCQX Exchange under the symbol “VHIBF”.

CAUTIONARY STATEMENT

Certain statements contained in this news release may constitute "forward-looking information" or "financial outlook" within the meaning of applicable securities laws that involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information or financial outlook. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "is expected", "expects", "scheduled", "intends", "contemplates", "anticipates", "believes", "proposes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. Such statements are based on the current expectations of the management of each entity and are based on assumptions and subject to risks and uncertainties. Although the management of each entity believes that the assumptions underlying these statements are reasonable, they may prove to be incorrect. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. No forward-looking statement can be guaranteed. Except as required by applicable securities laws, forward-looking statements speak only as of the date on which they are made and the Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

CONTACT INFORMATION

Dan Matlow

Chief Executive Officer, Director

(416) 727-9061

dan.matlow@VitalHub.com